Do you know which is the best credit card in India in terms of rewards points which you can redeem at different categories ? Have you ever wondered how different or close these credit card reward points are ? Let me take an example!

Ever thought the difference between how does 5X rewards from Standard Chartered differ from 10X rewards from Amex, ever wondered whether taking a 5% cash back is better than going for 10X rewards. Ever thought how can you save in excess of 16K per annum only by having a few cards in your wallet, well continue reading.

Every credit card company offers rewards in the form of Cashback /

Reward Points to its customers. These rewards are funded by what is

called as interchange. Interchange is transaction fees charged by the

bank from the merchant. Its usually 2 – 3 % of every transaction. This

is the reason, why some merchants ask an excess 2% if you tell them you

would be swiping your card instead of paying them in cash (Read some must know points about your credit card).

Cash is the preferred mode for another reason and that is to save

taxes, as every credit card transaction goes into the books of the

merchant, but that’s a separate discussion and we’ll leave it to some

other day.

A few disclaimers before I proceed. This article is about rewards points and how you can save maximum through credit cards. “A rupee earned is a rupee that earned 6 percent” – So lets save some money for all of you. Again the entire article has been based on my experience and research, so am open to suggestions and feedback. Also I haven’t included Airlines spend, as I still don’t fully understand the Points to Miles conversion for different Airlines.

Following are some of the points that I hope the readers will have a much better understanding of, by the end of the article.

Using the Burn Rate and the Earn Rate, I have come out with a very simple metric “Rupee earned per every Rs. 100 Spent” , which can be used to compare some of the top credit cards in the market.

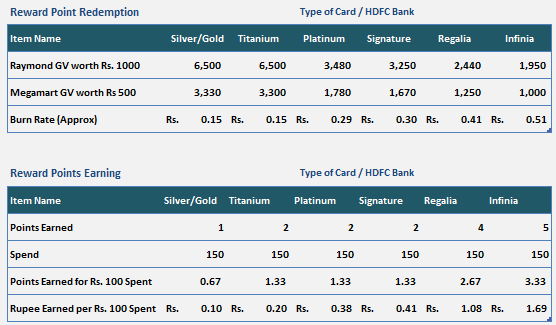

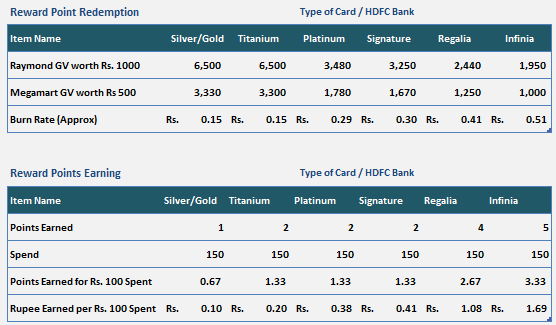

The above tables give us an idea of hdfc credit card reward points benefits in the market. If you look at the value proposition of different cards, they are vastly different in terms of Rupee Earned per Rs. 100 spent. Rs.100 spent on a HDFC silver/gold card will give you Rs. 0.10 whereas spending the same amount on Regalia will give you a Rs. 1.08 in terms of reward points. But again Regalia and Infinia are fee based cards and hence one needs to factor this in when computing the relative reward proposition of the card.

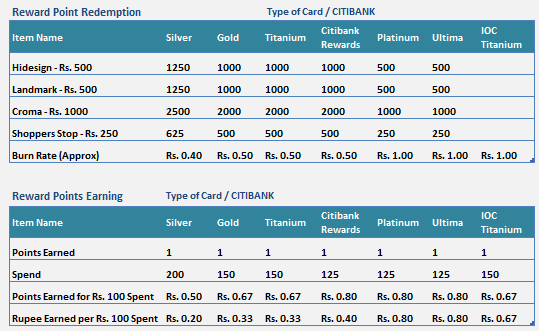

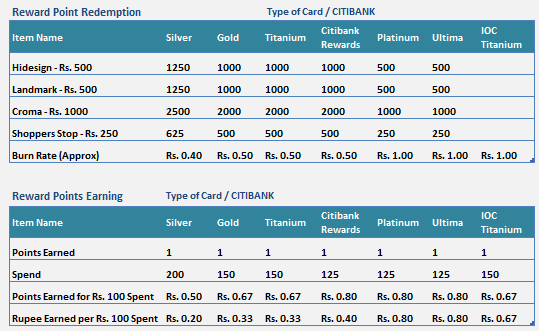

If we compare the same metric Rupee Earned per Rs. 100 spent, Platinum and Ultima cards are decent options and in the premium segment HDFC provides better rewards.

Now lets use the concept above and factor in the accelerated rewards propositions, (That some of these cards offer) to get to the best cards in each of the spend categories. The formula to calculate the rewards is a simple one: Just multiply the basic rewards earned above by the accelerated reward earning multiple.

Example - Rewards earned if you have spent Rs. 2000 on Citibank Rewards card.

The data has been collected from the sites and catalogues of different credit card companies. Since the accelerated rewards are mostly provided in specific categories, so we shall consider each category separately and figure the best card in that category.

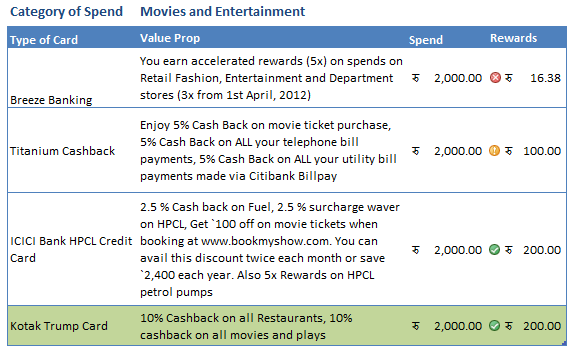

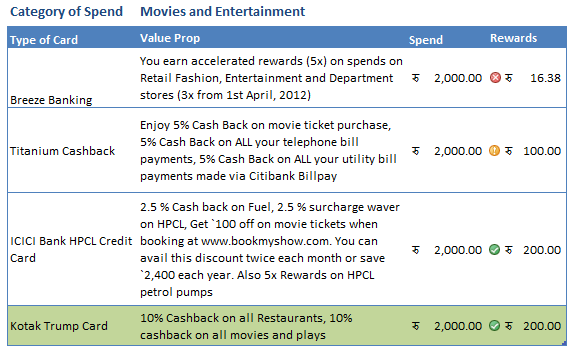

Carrying a similar analysis on categories of Movies and Entertainment and Utility Bills reveals that Kotak Trump card and Standard Chartered Titanium card emerge as the top card in the respective categories.

Ever thought the difference between how does 5X rewards from Standard Chartered differ from 10X rewards from Amex, ever wondered whether taking a 5% cash back is better than going for 10X rewards. Ever thought how can you save in excess of 16K per annum only by having a few cards in your wallet, well continue reading.

Click Here to join Personal Finance Action Revolution (Opens on 1st May)

A few disclaimers before I proceed. This article is about rewards points and how you can save maximum through credit cards. “A rupee earned is a rupee that earned 6 percent” – So lets save some money for all of you. Again the entire article has been based on my experience and research, so am open to suggestions and feedback. Also I haven’t included Airlines spend, as I still don’t fully understand the Points to Miles conversion for different Airlines.

Following are some of the points that I hope the readers will have a much better understanding of, by the end of the article.

- Comparing Credit cards by their rewards proposition – If you have multiple credit cards, how to figure which one has a better reward structure?

- Accelerated Rewards: Most of the credit cards have an accelerated reward structure. So how should that impact your spending pattern so as to maximize the rewards?

- Wallet of Credit cards that one should own – Using the methodology explained above, this would be a list of credit cards that will help maximize your savings.

Credit Card Reward Points & Cash Back Benefits

Lets start of with , How should one go about comparing credit cards by their rewards proposition. To understand this, there are two important concepts that one should be aware of- Earn Rate: Earn Rate is number of points earned per amount spent.

- Burn Rate: Burn Rate is the Rupee value of a reward point.

Using the Burn Rate and the Earn Rate, I have come out with a very simple metric “Rupee earned per every Rs. 100 Spent” , which can be used to compare some of the top credit cards in the market.

Rupee earned per every Rs. 100 spent = Earn Rate (Calculated on Rs. 100 Spent) * Burn RateAlso the comparisons below are based on the basic earnings. Most of the cards have an accelerated reward-earning proposition. We shall factor that when we calculate the monthly earnings from different spend scenarios. Also will show you how to create your own savings through your own spend numbers.

Example – 1

I will give you an example of how this metric would be useful to differentiate between two cards of the same bank or different cards across the bank.

The above tables give us an idea of hdfc credit card reward points benefits in the market. If you look at the value proposition of different cards, they are vastly different in terms of Rupee Earned per Rs. 100 spent. Rs.100 spent on a HDFC silver/gold card will give you Rs. 0.10 whereas spending the same amount on Regalia will give you a Rs. 1.08 in terms of reward points. But again Regalia and Infinia are fee based cards and hence one needs to factor this in when computing the relative reward proposition of the card.

Example – 2

Now lets compare HDFC reward points with CITIBANK rewards points

If we compare the same metric Rupee Earned per Rs. 100 spent, Platinum and Ultima cards are decent options and in the premium segment HDFC provides better rewards.

Accelerated Rewards – Categories of Spend and Best card in each category

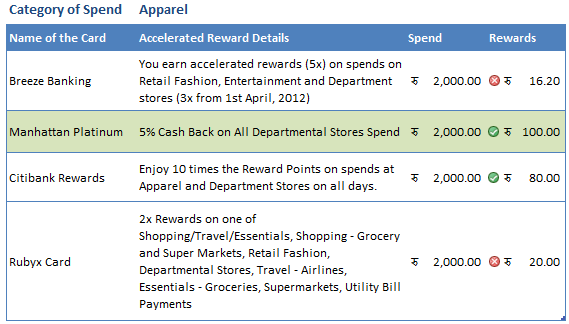

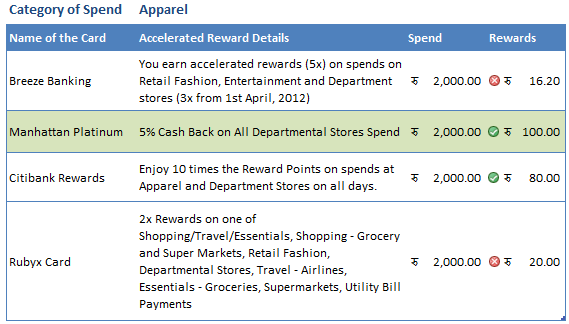

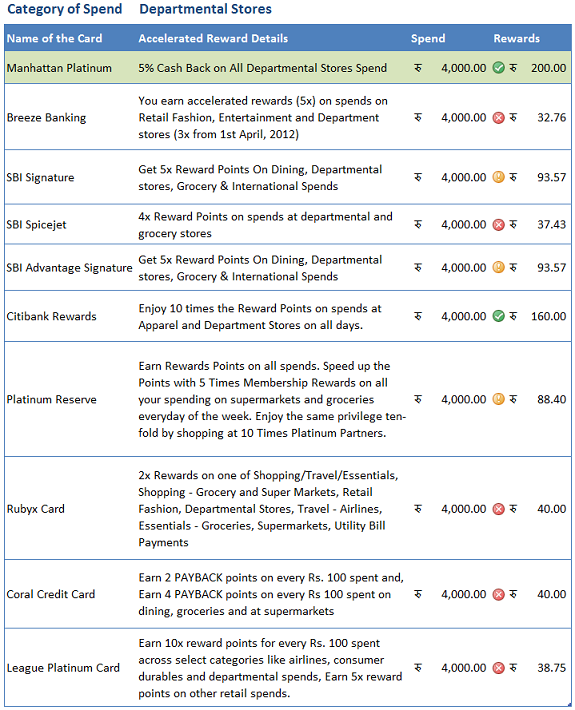

Apart from the basic reward proposition that’s present with every credit card, most of the cards in the market offer an accelerated rewards earning proposition. These accelerated rewards can be in a variety of forms. E.g. 5x rewards on Departmental Stores, 10X rewards on Online spends or a 5% cashback on Departmental Stores.Now lets use the concept above and factor in the accelerated rewards propositions, (That some of these cards offer) to get to the best cards in each of the spend categories. The formula to calculate the rewards is a simple one: Just multiply the basic rewards earned above by the accelerated reward earning multiple.

Formula

Rewards Earned = (Rupee Earned per Rs. 100 Spent) * (Accelerated Reward Earning multiple)*Spend/100Example - Rewards earned if you have spent Rs. 2000 on Citibank Rewards card.

- For Citibank Rewards, Rupee Earned per Rs. 100 spent = Rs. 0.4

- Accelerated Reward Earning : 10X on Departmental Stores

- Rewards Earned = 10*0.4*2000/100 = Rs. 80

- A few credit card companies even though offer accelerated rewards proposition but offer it only on select merchants. For e.g. Amex offer 10X rewards on its partner merchants, CITI rewards card offers it on select merchants, etc.. If you do not shop on these merchants then you won’t be earning any accelerated rewards. That’s the reason I prefer credit cards which offer a flat accelerated rewards structure so that I get the freedom of shopping wherever I want to

- Also some of these accelerated rewards have a validity, which means have an expiry date. You are eligible for accelerated rewards only in that period.

- Also I have a preference for Cash back as compared to reward accumulation, reason being two fold. First: Cashback impact my outflows directly as compared to rewards (where one has to go through the process of reward redemption and its benefits). Second: Its faster.

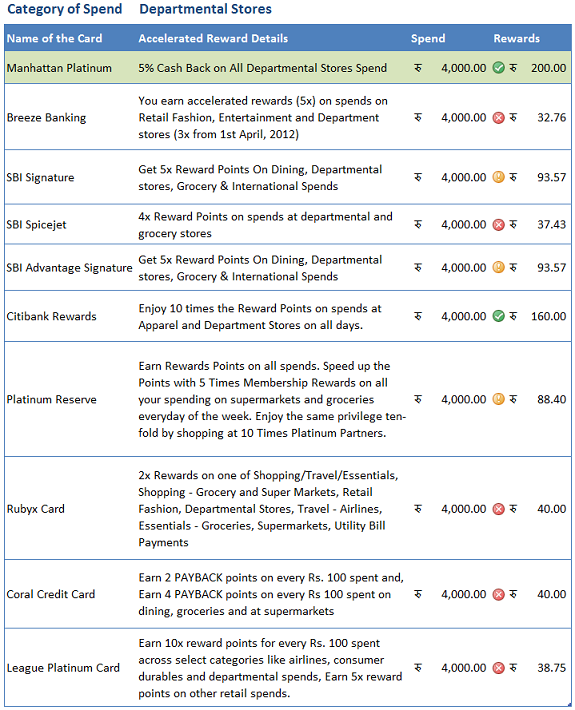

The data has been collected from the sites and catalogues of different credit card companies. Since the accelerated rewards are mostly provided in specific categories, so we shall consider each category separately and figure the best card in that category.

Winner - Manhattan Platinum Card

Even though it seems, owning a Citibank Rewards card will give you,

Rs. 80 cash back, but that’s just superficial because the 5X rewards on

Citibank card is limited to only a few stores. Lifestyle being the major

one of them.For Manhattan Platinum card, even though the offer tells

only about Departmental stores, it covers all kinds of retail spends.

Spends in malls are covered by this offer

Winner - Manhattan Platinum

Again it’s a straight fight between Manhattan Platinum and Citibank Rewards. And Manhattan Platinum wins hands down.

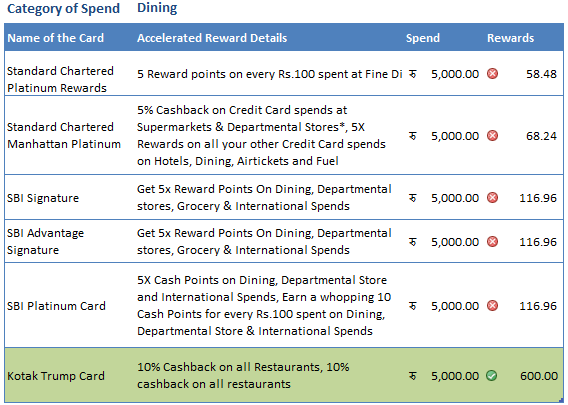

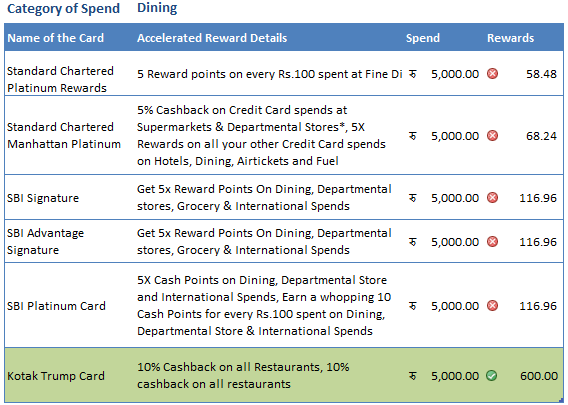

Winner – Kotak Trump Card

Clearly Kotak Trump card is the clear winner. With you saving almost

Rs. 600 per month if you are a heavy diner. There are a few finer

points, that the total spends on Movies and Restaurants should be more

than Rs. 4000. There are a few other cards, where the card issuing

companies have a tie up with specific restaurants in different cities.

Citibank being one of them where they have tied up with more than 200

merchants across India and offer a 20 % discount flat.

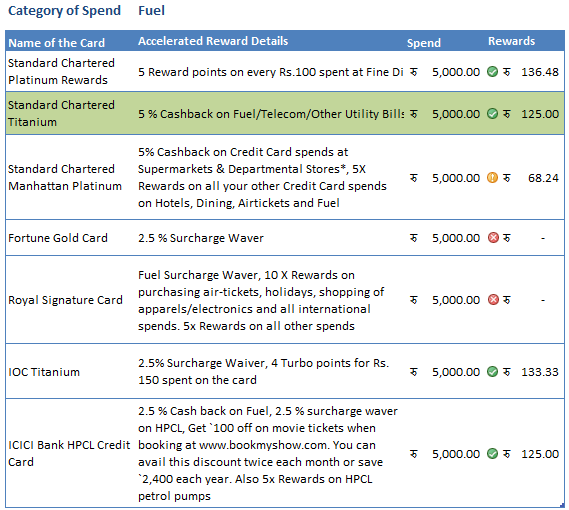

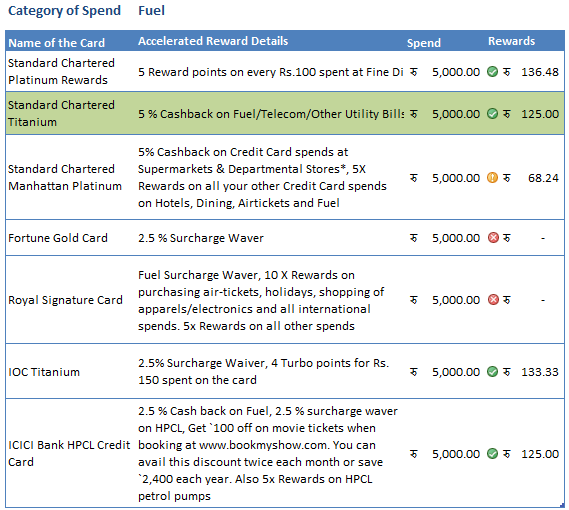

Winner - Standard Chartered Titanium

Standard Chartered Platinum Rewards, Standard Chartered Titanium, IOC

Titanium and ICICI Bank HPCL card are quite close in terms of the

monthly earnings. But I like cashback more than earnings through reward

points. Also the 5% flat cashback on any petrol pump as compared to IOC

and HPCL for Citibank and ICICI bank cards respectively make Standard

Chartered Card a winner in this category.

Winner – Standard Chartered Titanium

Standard Chartered Platinum Rewards, Standard Chartered Titanium, IOC

Titanium and ICICI Bank HPCL card are quite close in terms of the

monthly earnings. But I like cashback more than earnings through reward

points. Also the 5% flat cashback on any petrol pump as compared to IOC

and HPCL for Citibank and ICICI bank cards respectively make Standard

Chartered Card a winner in this category.

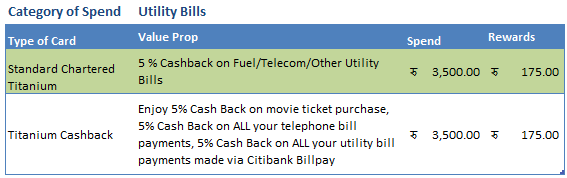

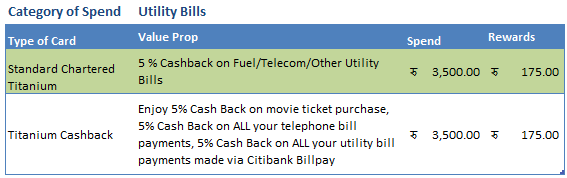

Winner – Standard Chartered Titanium Card

Again , both the cards are equally good, but the additional condition

of paying your bills via Citibank billpay turns my preference towards

Standard Chartered Titanium card.Carrying a similar analysis on categories of Movies and Entertainment and Utility Bills reveals that Kotak Trump card and Standard Chartered Titanium card emerge as the top card in the respective categories.

Wallet of Credit cards that one should own

Having done the hard bit of analysis, calculations and comparisons we come to the easier bit of creating a wallet of credit cards for you which will accelerate the reward earning and help you save a substantial amount over a period of time. To give you all an idea about savings that can be done by having this wallet, I have created a few scenarios and the respective savings. One can create his/her own spend/rewards scenarios using the table below.| Category of Spend | Name of the Card | Value Proposition | Monthly Spend | Monthly Savings | Annual Savings |

| Apparel | Standard Chartered – Manhattan Platinum | 5% Cash Back on All Departmental Stores Spend, (This includes all kinds of Retail Spends) | 2,000 | 100 | 1,200 |

| Departmental Stores | Standard Chartered – Manhattan Platinum | 5% Cash Back on All Departmental Stores Spend, (This includes all kinds of Retail Spends) | 4,000 | 200 | 2,400 |

| Dining | Kotak Trump Card | 10% Cashback on all Restaurants, 10% cashback on all restaurants | 5,000 | 600 | 7,200 |

| Fuel | Standard Chartered – Titanium Card | 5 % Cashback on Fuel/Telecom/Other Utility Bills | 5,000 | 125 | 1,500 |

| Movies and Entertainment | Kotak Trump Card | 10% Cashback on all Restaurants, 10% cashback on all restaurants | 2,000 | 200 | 2,400 |

| Utility Bills | Standard Chartered – Titanium Card | 5 % Cashback on Telecom/Other Utility Bills | 3,500 | 175 | 2,100 |

| 21,500 | 1,400 | 16,800 |

No comments:

Post a Comment